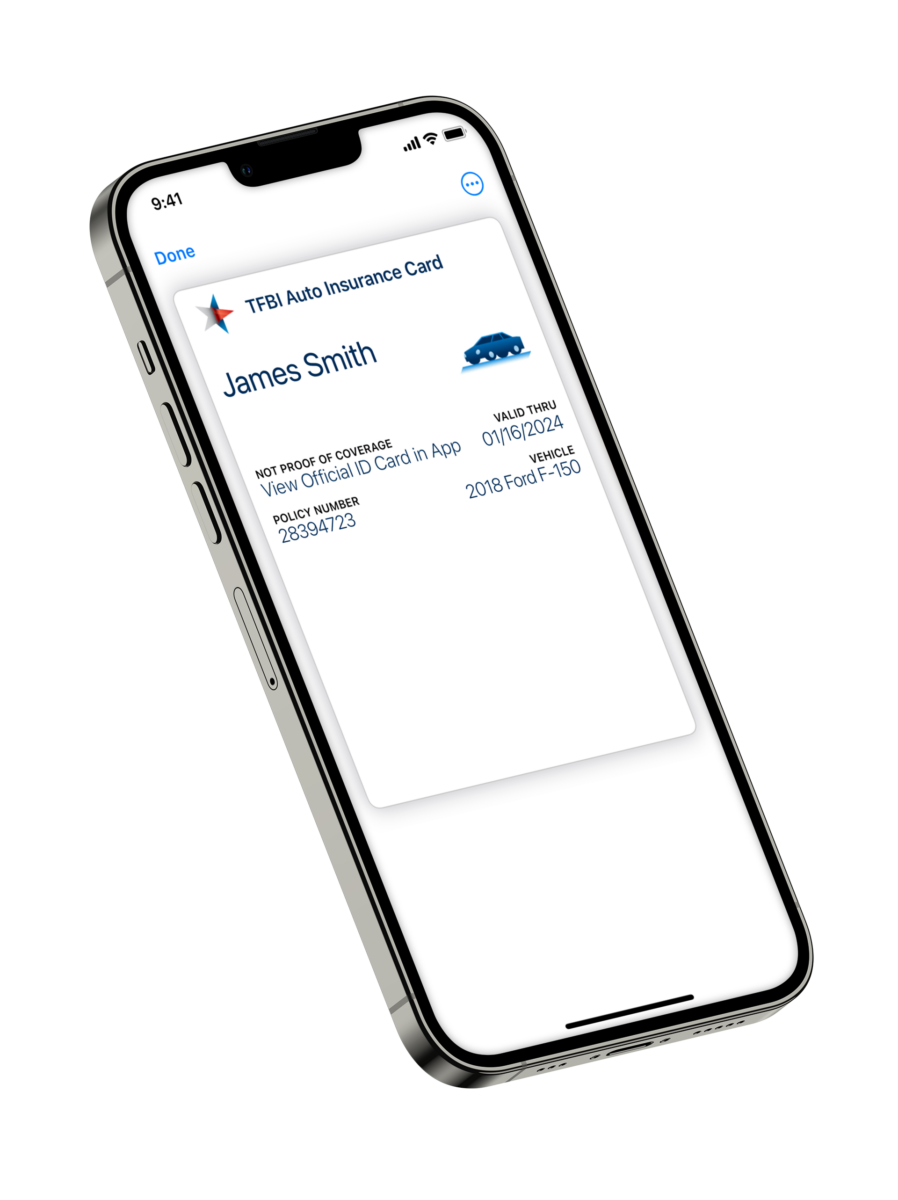

payments made in app

0

Texas Farm Bureau Insurance, established in 1952, provides comprehensive insurance solutions to Texans across the state. With a focus on serving the needs of rural communities and beyond, the company offers a wide array of insurance products including auto, home, farm, and life insurance. Texas Farm Bureau Insurance assists their 500,000+ policyholders with the everyday management of financial risks and insurance coverage. Committed to its founding principles of integrity, community support, and exceptional customer service, Texas Farm Bureau Insurance continues to be a trusted partner for individuals and families seeking reliable coverage and peace of mind.

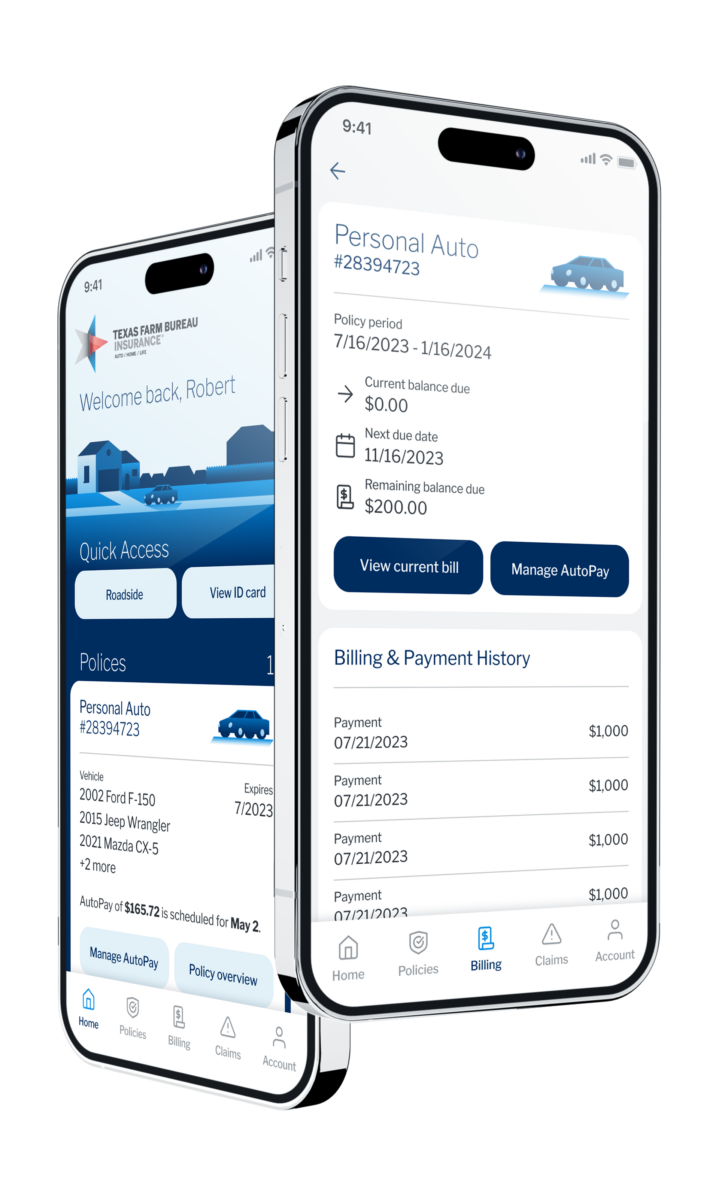

Exceptional, JD Power award-winning customer service is something to be proud of, but relying on it due to a lack of digital options is far from ideal. Texas Farm Bureau Insurance realized that their existing app left policyholders turning to customer support for even simple tasks. To transform their digital experience, they focused on understanding the unique journeys, needs, and pain points of their target personas. Their goal was to create a seamless, empowering experience that enabled policyholders to handle common tasks quickly and effortlessly, ultimately driving customer satisfaction, retention, and app usage.

Our goal was to create an ‘agent in your pocket’ experience while laying a foundation for continuous learning and improvement. This required a deep understanding of policyholders’ needs, pain points, and opportunities drawn from leading digital experiences across industries. Through in-depth user interviews with both customers and non-customers, we gathered valuable insights on choosing a provider, understanding policies, submitting claims, and mobile app expectations.

Within a speedy nine months, we delivered a product that both solved well-informed issues for policyholders and gave new life to the brand.

Together, Bottle Rocket and Texas Farm Bureau Insurance overhauled the customer’s entire digital experience by leveraging key findings from industry research. Through streamlining how policyholder needs were met, the entire customer service system was improved.